KLCCP Stapled Group represents more than just architectural structures; it embodies Malaysia's ambition to stand tall on the global stage. Anchored by the PETRONAS Twin Towers, a world-renowned icon of modernity and elegance, our portfolio demonstrates the pinnacle of planning, design, and sustainability.

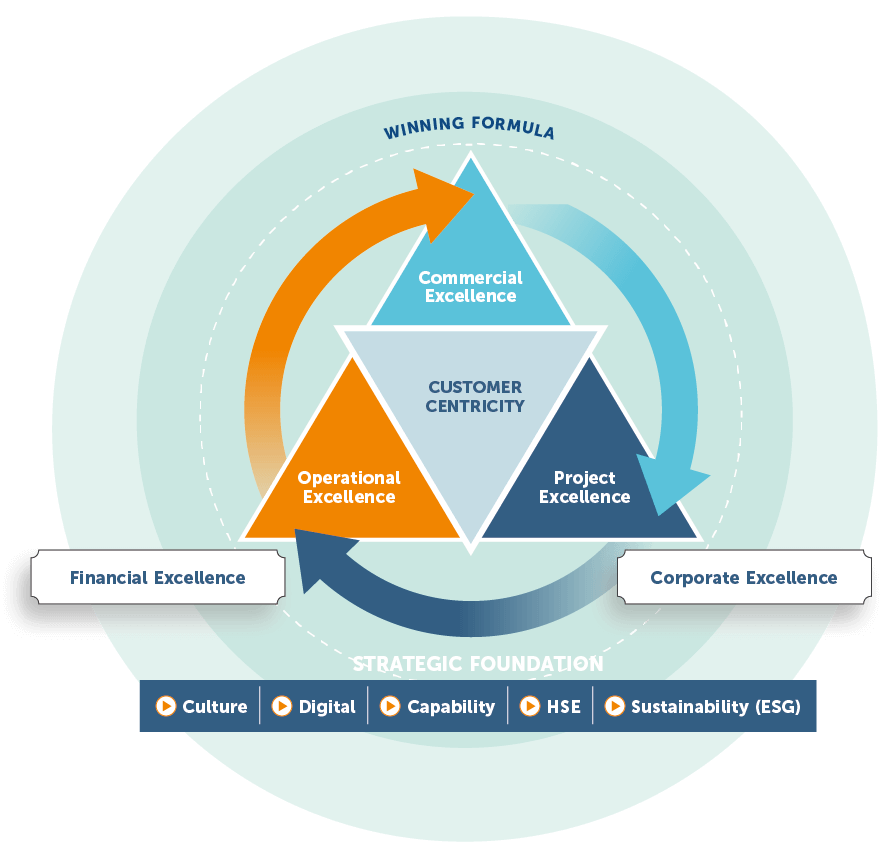

As Malaysia's largest Real Estate Investment Trust (REIT), we are unwavering in our commitment to delivering long-term value to stakeholders, ensuring every development reflects our pursuit of excellence. We go beyond creating spaces; we create experiences that resonate with our communities, blending functionality, environmental responsibility, and thoughtful design.

Our global reputation is built on fostering innovation, setting new benchmarks in real estate, and aligning with global sustainability goals. Through our work, we not only shape the skyline but also reinforce Malaysia's status as a hub for excellence. KLCCP Stapled Group continues to lead; inspiring progress and ensuring that our assets and the experiences we create serve as a successful global icon of excellence.